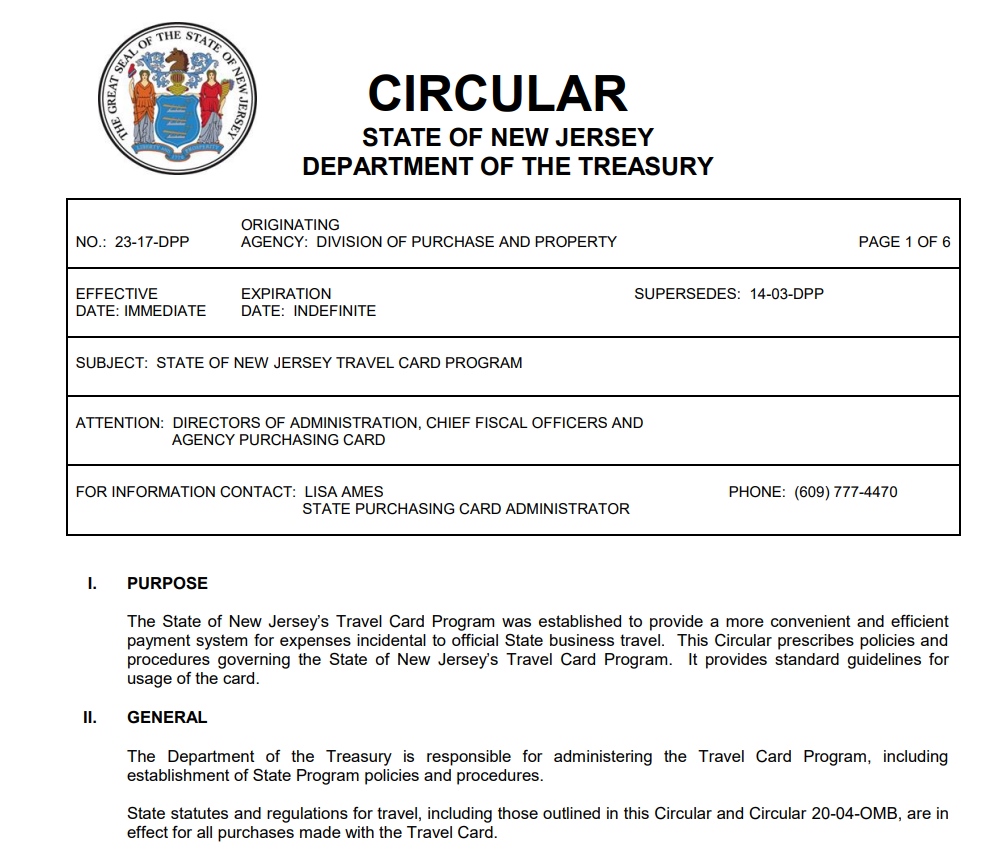

The fy 2025 appropriations act provided approximately $2.09 billion. New jersey's anchor tax rebate program was a hallmark of the 2025 budget, and the department of the treasury is already looking ahead to 2025.

The date we issued a benefit (including if it was applied to your property tax bill for tax year 2018). Qualifying homeowners and renters over age 65 were eligible for an.

The date we issued a benefit (including if it was applied to your property tax bill for tax year 2018).

Phil murphy delivers his state of the state address to a joint session of the legislature at the statehouse, in trenton, n.j., jan.

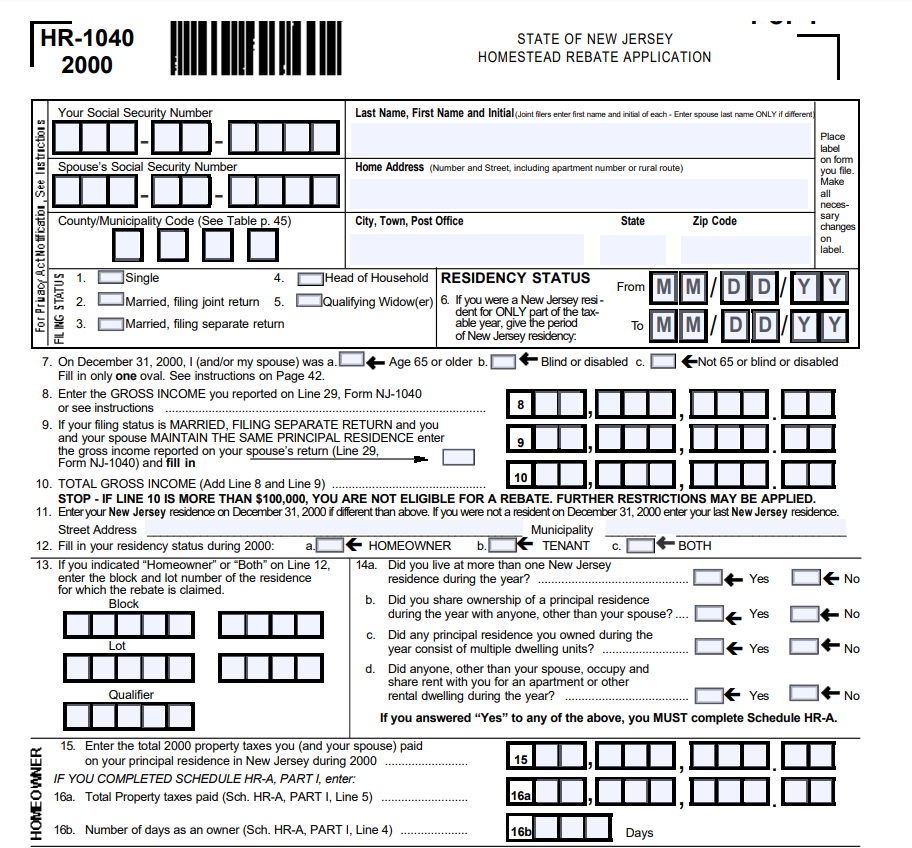

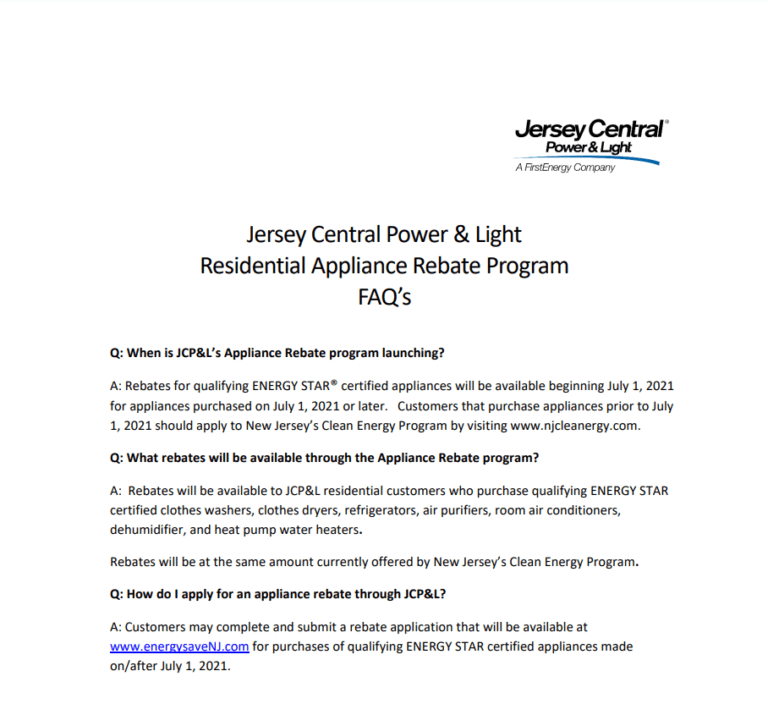

File NJ Homestead Rebate Form Online Printable Rebate Form, Qualifying homeowners and renters over age 65 were eligible for an. The anchor program provides rebates of up to $1,500 to eligible homeowners and $450 to eligible tenants.

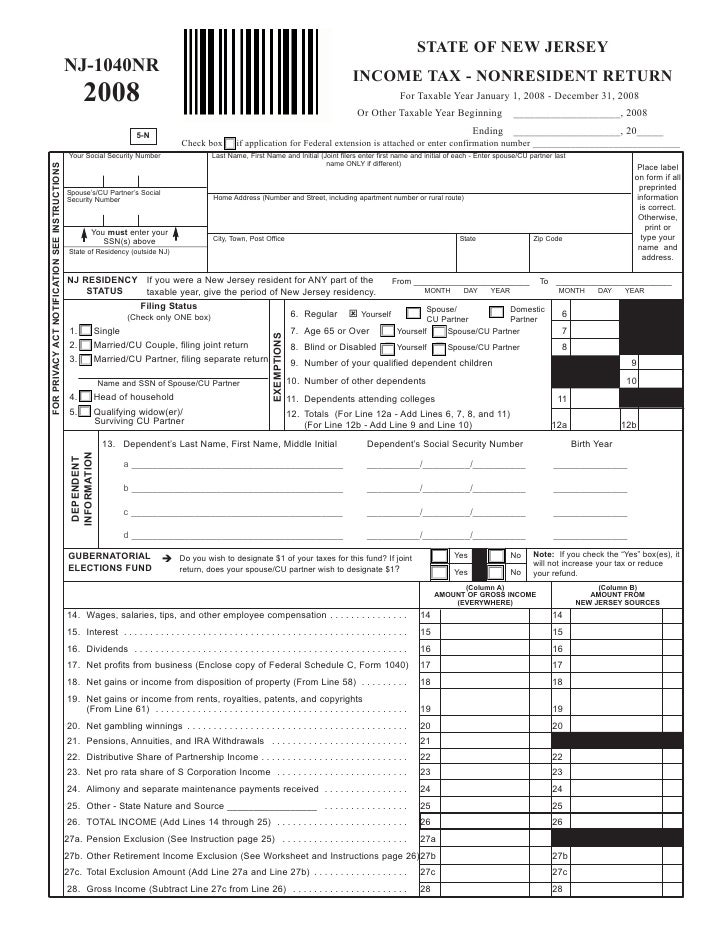

When will I be eligible for the Homestead Rebate?, The current filing season for the anchor benefit is based on 2025 residency,. A 2.5% surtax — known as a “corporate transit fee” — on the 600 companies in new jersey that make at least $10 million.

Tenant Homestead Rebate Instructions, (ap) — new jersey democratic gov. For most homeowners, the benefit is distributed to your municipality in the form of a credit, which reduces your property taxes.

State freezes payments for homestead rebate program Video NJ, Under the new program, known as anchor, homeowners making up to $150,000 will receive $1,500 rebates on their property tax bills, and those making. The fy 2025 appropriations act provided approximately $2.09 billion.

NJ Homestead, Phil murphy on tuesday unveiled a $53.1 billion budget for fiscal year 2025, about 5% more than the spending plan he signed for the current year,. For most homeowners, the benefit is distributed to your municipality in the form of a credit, which reduces your property taxes.

What’s the maximum for the Homestead Rebate?, This program provides property tax relief to new jersey residents who own or rent property in new jersey as their principal residence and meet certain income limits. It’s confusing, but the anchor property tax benefit, like the homestead rebate before it, runs behind the actual calendar year.

Halloween snowstorm extends application deadlines for N.J. Homestead, The $2 billion anchor benefit program replaced the homestead rebate in 2025 as new jersey's primary program for property tax relief, and tripled the number of. The current filing season for the anchor benefit is based on 2025 residency,.

NJ Homestead Rebate What to Know Credit Karma, Under this program, homeowners with a household income of less than $150,000 can get a $1,500 rebate, homeowners with a household income between. Phil murphy friday evening includes $220 million for staynj, a tax break for seniors designed to help older residents remain.

Nj Renters Rebate 2025 Mira Sybila, The current filing season for the anchor benefit is based on 2025 residency,. The agreement would set aside around $140 million for fiscal years 2025 and 2025.

Is the Homestead Rebate for homeowners running late?, Under the anchor property tax relief program, homeowners making up to $250,000 per year are eligible to receive an average $700 rebate in fy2023 to offset. Under the new program, known as anchor, homeowners making up to $150,000 will receive $1,500 rebates on their property tax bills, and those making.

In addition, the state would set aside about $100 million, $200 million and $300 million for each of the next.